Active ETFs Are Booming — Is Your Compliance Framework Ready? Active ETFs Are Booming — Is Your Compliance Framework Ready?

The SEC just confirmed what the market already suspected: active ETFs are no longer the little sibling of passive index funds. They are a structural force reshaping the investment management landscape — and your compliance infrastructure needs to keep pace.

On February 5, 2026, the SEC's Division of Economic and Risk Analysis (DERA) published "The Fast-Growing Market of Active ETFs," a data-driven report examining the characteristics and rapid expansion of actively managed exchange-traded funds. The findings carry significant implications for fund boards, chief compliance officers, and investment advisers navigating an increasingly complex regulatory environment.

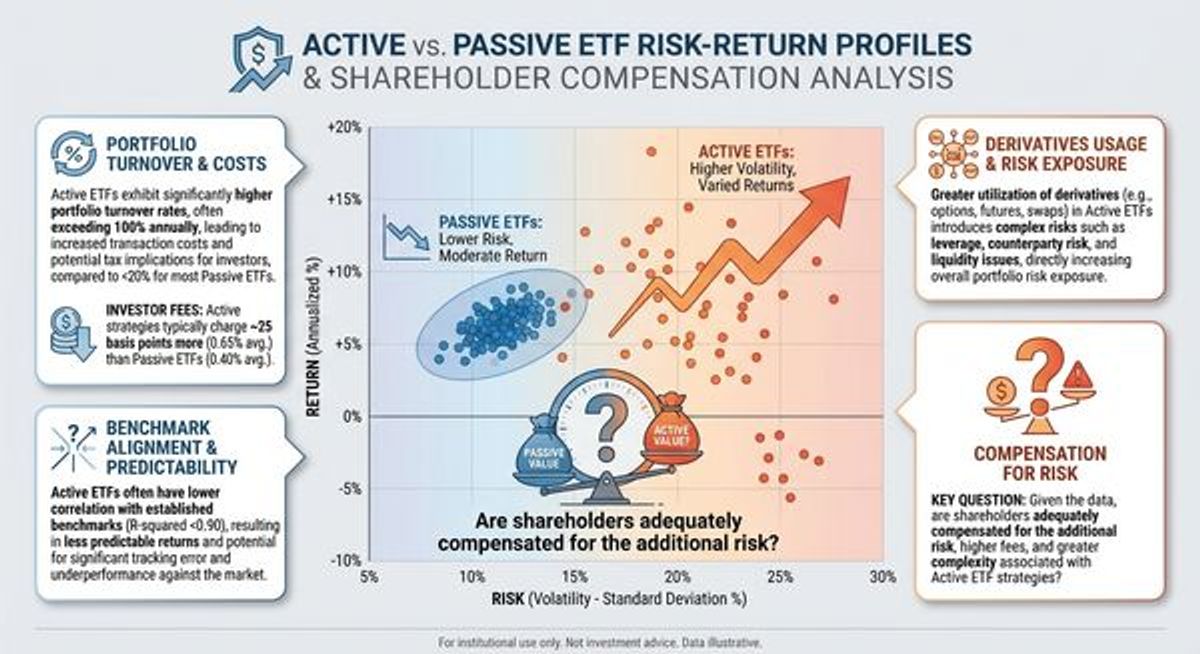

But these are not your grandpa’s active funds. Many of these newer active ETFs rely heavily on derivatives as opposed to direct purchases of securities like stocks, bonds, etc. The result is that many of these actively managed ETFs are riskier than their passive siblings. That’s not necessarily a bad thing so long as investors are compensated for the risk. The question remains: “are they.?”

What the DERA Report Found

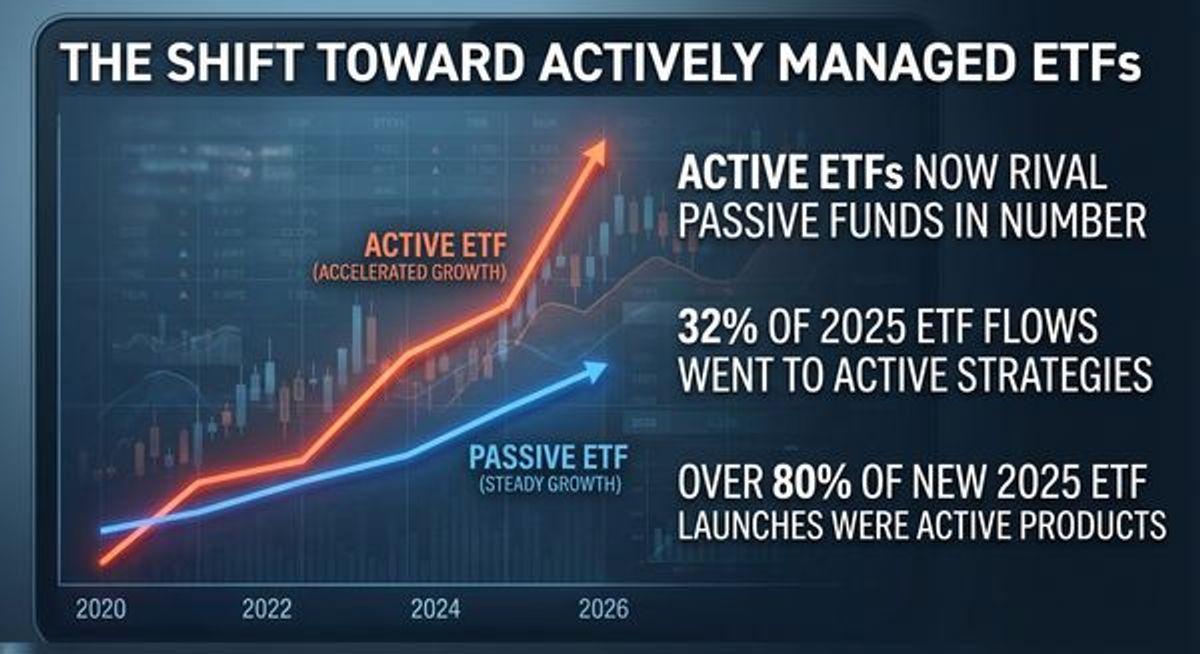

The headline numbers are striking. The U.S. ETF market now encompasses more than 3,600 funds holding assets exceeding $10 trillion. As Dr. Joshua T. White, DERA's Chief Economist and Director, noted in the accompanying press release, active ETFs "are growing rapidly and now rival passive funds in number, reflecting a shift toward more actively managed strategies."

But the real story lies beneath those topline figures. DERA found that active ETFs exhibit meaningfully different portfolio characteristics compared to their passive counterparts. Specifically, the report identified three distinguishing features: lower return alignment with underlying benchmark returns, higher portfolio turnover rates, and greater use of derivatives. These are not merely academic observations — each one carries distinct compliance obligations that fund sponsors and their boards cannot afford to overlook.

Compliance Implications Fund Boards Should Be Watching

Derivatives Risk Management Under Rule 18f-4. Active ETFs' greater use of derivatives places Rule 18f-4 squarely at the center of compliance planning. Funds that qualify as "limited derivatives users" must monitor notional exposure to ensure it stays below the 10% threshold. Those exceeding that limit need a comprehensive derivatives risk management program, a designated derivatives risk manager, and board reporting on derivatives activity. With active strategies increasingly incorporating options overlays, swaps, and futures, boards should be confirming — not assuming — that their fund's derivatives framework matches its actual trading activity.

Portfolio Transparency and Rule 6c-11. The ETF regulatory framework under Rule 6c-11 requires daily portfolio holdings disclosure for funds relying on the rule's exemptive relief. For actively managed strategies with higher turnover and more frequent position changes, the operational demands of daily transparency are more acute. Fund sponsors need robust systems to ensure timely, accurate disclosure, and boards should be asking whether current processes can handle the pace of trading that active management demands.

Section 15(c) Contract Renewal Analysis. Higher fees are a reality in active ETFs. Investors currently pay an average of 25 basis points (0.25%) more for active strategies than passive ones, according to Bloomberg data. That premium makes the board's annual Section 15(c) review — the "Gartenberg analysis" evaluating the reasonableness of advisory fees — all the more important. Directors need to rigorously assess whether the adviser is delivering genuine active management that justifies the cost differential, particularly in light of DERA's finding that some active ETFs demonstrate limited benchmark deviation despite their active classification.

The Multi-Share Class Dimension. The SEC's November 2025 approval of multi-share class ETFs for Dimensional Fund Advisors, with nearly 80 additional applicants in the queue, adds another layer of complexity. Sponsors converting mutual fund strategies into ETF share classes will need to address governance, pricing, and compliance considerations across both wrappers simultaneously. Boards overseeing these transitions should be engaging counsel early in the process.

Why This Matters Now

The pace of active ETF growth is accelerating, not stabilizing. Active strategies attracted approximately $475 billion in inflows during 2025, representing 32% of all ETF flows despite holding only 11% of total market assets. Over 80% of new ETF launches in 2025 were active products. Industry projections suggest active ETF inflows could reach $620 billion in 2026.

That growth trajectory means compliance frameworks built for a predominantly passive ETF world are due for a serious upgrade. The SEC's decision to publish this DERA report signals the agency's focus on understanding — and likely scrutinizing — this market segment more closely.

Key Takeaways

- The DERA report confirms active ETFs now rival passive funds in number and exhibit meaningfully different risk characteristics, including higher turnover and greater derivatives usage.

- Rule 18f-4 compliance is critical for active ETFs employing derivatives strategies. Boards should verify whether their funds' derivatives risk management programs reflect current trading activity.

- Daily portfolio transparency under Rule 6c-11 creates heightened operational demands for actively managed strategies with frequent position changes.

- Section 15(c) fee evaluations require enhanced scrutiny given the premium investors pay for active management and DERA's findings on benchmark alignment.

- Multi-share class ETF conversions will introduce additional governance and compliance layers that boards should plan for now.

Positioning Your Fund for Regulatory Confidence

The active ETF boom is creating enormous opportunities for sponsors and investors alike. But opportunity without compliance infrastructure is exposure waiting to happen. Fund boards and advisers that proactively assess their governance frameworks — from derivatives oversight to fee analysis to portfolio disclosure systems — will be best positioned as the SEC continues to sharpen its focus on this rapidly evolving market.

Need expert guidance on active ETF compliance and fund governance? FinTech Law provides comprehensive registered fund legal services, including board governance, regulatory compliance, and ETF-specific counsel. Contact us today to schedule a consultation.

Disclaimer: This article is for informational purposes only and does not constitute legal advice or create an attorney-client relationship. Consult qualified legal counsel for guidance specific to your situation.