Fund Mergers Cut Fees -- But Not Equally

The SEC just handed fund boards a valuable new dataset. On February 5, the Commission's Division of Economic and Risk Analysis (DERA) published When Funds Merge: What Happens to Fees?, a working paper analyzing over 1,800 mutual fund and ETF mergers between 2011 and 2023. The takeaway for fund directors and compliance teams: mergers generally reduce fees for investors in acquiring funds, but the magnitude of those savings depends heavily on what kind of fund you are running and how the merger is structured.

For boards evaluating a proposed fund merger, this research provides a data-driven benchmark that should inform the Section 15(c) process and fee negotiations.

What the Data Shows

DERA economist Ricardo A. Lopez Rago used a difference-in-differences methodology to isolate the fee impact of mergers from broader industry-wide trends in declining expense ratios. The study examined three fee components -- expense ratios, management fees, and 12b-1 fees -- across equity, bond, and mixed funds.

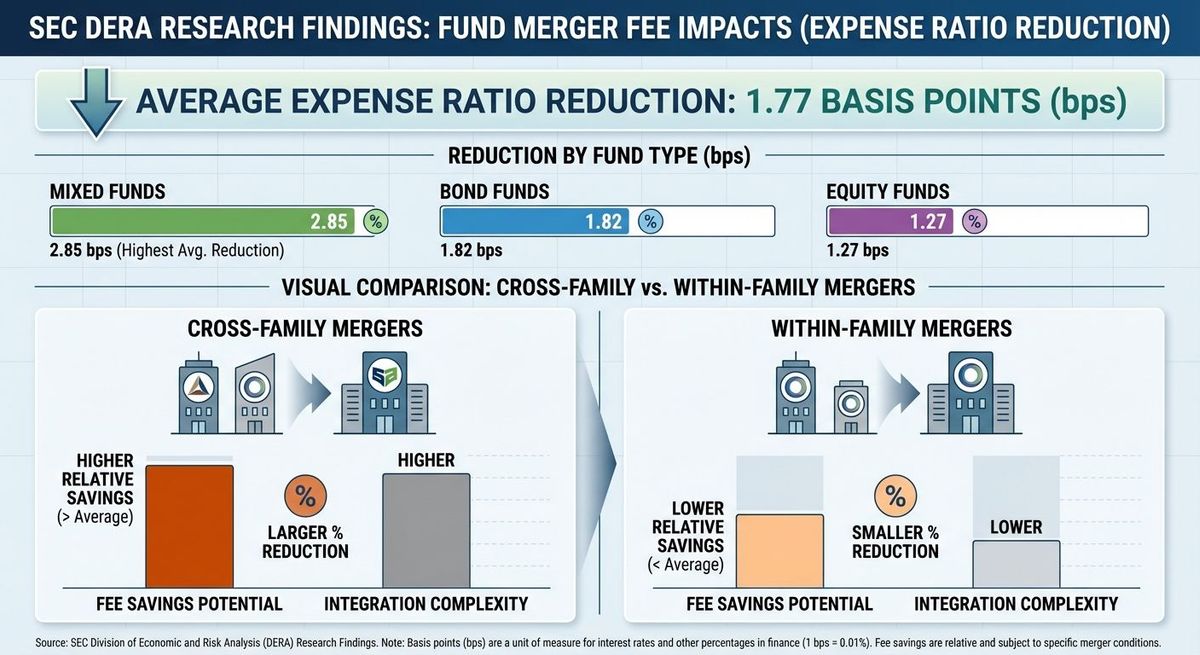

The headline finding: mergers reduce expense ratios by an average of 1.77 basis points for acquiring funds. That translates to a fund with a 1.00% expense ratio dropping to roughly 0.98% post-merger. Modest on its face, but meaningful when compounded across large asset bases over time.

The more interesting story is in the details.

Mixed and Bond Funds See the Biggest Savings

Not all fund types benefit equally from merger-related fee reductions. Mixed funds -- those holding a combination of equities and fixed income -- experienced the largest expense ratio decline at 2.85 basis points, followed by bond funds at 1.82 basis points. Equity funds trailed at just 1.27 basis points.

The same pattern held for management fees. Mixed funds saw a 4.49 basis point reduction in management fees, while bond funds dropped 1.41 basis points. Equity funds showed no statistically significant change at all.

Why the disparity? The paper suggests that equity funds may already operate at relatively efficient scale, or face structural costs that consolidation alone cannot address. For boards overseeing bond or mixed fund complexes, this data offers a stronger case that merger proposals can deliver tangible fee relief to shareholders.

Merger Structure Matters

How you merge matters as much as what you merge. The DERA data breaks down results across three merger types: within-family (same fund complex), cross-family (different fund families), and share class consolidations.

Cross-family mergers and share class consolidations drove the most significant expense ratio reductions -- each at 2.26 basis points on average. Within-family mergers, which account for the majority of activity (65% of all mergers studied), showed no statistically significant reduction in overall expense ratios.

The standout combinations were cross-family mergers involving mixed funds (a 4.61 basis point expense ratio reduction) and share class consolidations in bond funds (a 5.03 basis point reduction). These are the merger structures where fund boards should expect the most meaningful fee benefits for shareholders.

12b-1 Fees Barely Budge

Here is a finding that will surprise no one in fund administration: 12b-1 fees remain essentially unchanged after mergers. Across nearly all fund types and merger structures, the paper found no statistically significant movement in these distribution and servicing fees.

The reason is structural. Unlike management fees, which can be renegotiated as part of post-merger integration, 12b-1 fees are governed by longstanding distribution agreements and regulatory caps under FINRA Rule 2341. These arrangements are embedded in fund structures and are notoriously difficult to rework, even when the broader economics of the fund have changed.

For boards reviewing merger proposals, this means the fee savings story is really about expense ratios and management fees -- not distribution costs. Any projections promising material 12b-1 savings post-merger should be met with healthy skepticism.

What This Means for Fund Boards

This research arrives at a useful moment. The U.S. mutual fund and ETF industry manages over $32.7 trillion in assets and the market continues to consolidate. For fund directors evaluating merger proposals, DERA's analysis provides a concrete, data-backed framework for assessing whether projected fee benefits are realistic.

A few practical considerations for boards and compliance teams:

- Use this data as a benchmark in your Section 15(c) analysis. When evaluating the advisory contract renewal for a post-merger fund, the DERA findings can help boards assess whether realized fee savings are in line with industry norms.

- Scrutinize equity fund merger projections carefully. The data shows equity funds are least likely to realize fee reductions, so merger proposals premised primarily on cost savings deserve extra diligence.

- Look beyond headline expense ratios. The fee reduction story varies significantly by component (management fees vs. 12b-1 fees) and by merger type. Boards should require advisers to break down projected savings at this level of granularity.

- Remember that lower fees do not guarantee better returns. The paper explicitly notes that post-merger performance can be affected by decreasing returns to scale or integration inefficiencies. Fee analysis is necessary but not sufficient.

Key Takeaways

- Fund mergers generally reduce expense ratios and management fees for acquiring funds, with an average expense ratio decline of 1.77 basis points.

- Mixed and bond funds benefit most, with expense ratio reductions of 2.85 and 1.82 basis points respectively; equity funds see minimal savings.

- Cross-family mergers and share class consolidations deliver the largest savings, while within-family mergers show limited fee impact.

- 12b-1 fees remain largely unchanged after mergers due to the rigidity of distribution agreements.

- Fund boards should use this data to benchmark fee expectations during merger evaluations and Section 15(c) contract renewal processes.

Conclusion

The DERA working paper confirms what experienced fund counsel have long observed: mergers can be an effective tool for reducing investor costs, but the benefits are far from automatic. The structure of the deal, the type of fund, and the specific fee components all shape the outcome. For fund boards navigating these decisions, having experienced counsel who understands both the regulatory framework and the economic realities of fund consolidation is essential.

Need guidance on a fund merger, reorganization, or Section 15(c) process? Contact FinTech Law to discuss how we can support your fund board.

An Important Caveat

This is a DERA staff working paper, not a Commission determination. The standard disclaimer applies: the findings represent the author's views and do not necessarily reflect the views of the Commission or its staff. That said, it is among the most comprehensive empirical analyses of fund merger fees available, drawing on the CRSP Survivor-Bias-Free database to avoid the survivorship bias that has limited earlier studies.