SEC Chairman Atkins Signals New Era for Private Markets Access: From Systemic Risk Fears to Democratized Investment Opportunities

October 22, 2025

Key Takeaway: SEC Chairman Paul Atkins' dismissal of private credit as a systemic risk heralds a transformative regulatory shift, unlocking retail access to the $2.5 trillion private markets via closed-end funds—while raising critical questions about investor protection and market stability.

Essential Reading:

- SEC Private Funds: Retail Access 2025 - Complete guide to the new retail access framework

- Closed-End Funds & Private Investment Restrictions: SEC History - The complete backstory on the 15% restriction

The Paradigm Shift: Dismissing the Systemic Risk Narrative

Financial regulators once viewed private markets as a potential tinderbox requiring strict oversight. Today, they're opening those markets to everyday investors. At a conference hosted by the Managed Funds Association in New York on October 7, 2025, SEC Chairman Paul Atkins declared: "I view the private markets as very important," explicitly rejecting characterizations of private credit as a systemic threat.

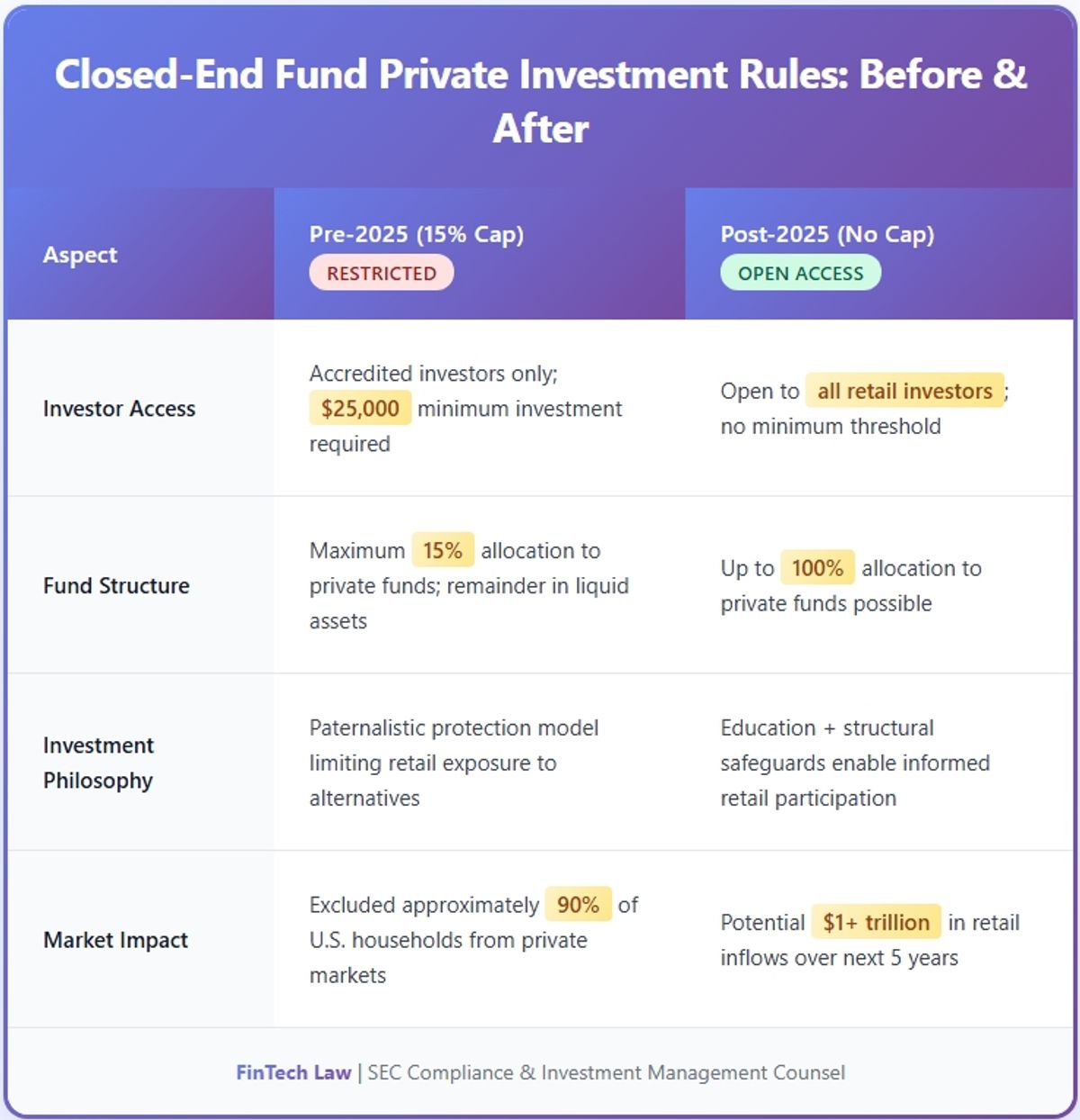

This represents a fundamental break from the Gary Gensler era, when the Commission expanded Form PF reporting and pursued sweeping private fund reforms to address concerns about opacity and interconnectedness in markets approaching $2.5 trillion. Atkins' approach prioritizes capital formation over precautionary regulation—paired with the SEC's May 2025 removal of the 15% cap on closed-end fund investments in private assets (analyzed in our retail access guide), it marks the most significant democratization of private markets since the 1980s.

Atkins held similar views during his previous SEC tenure. In 2008, he suggested Wall Street troubles might not impact Main Street—weeks before the financial crisis erased over $19 trillion in household wealth. Whether his current optimism proves more prescient remains the trillion-dollar question.

The 15% Barrier: Two Decades of Informal Restriction

To understand this pivot's significance, we must examine the barriers that have governed retail access to private markets. For the complete historical evolution, see our comprehensive analysis.

Since 2002, SEC staff maintained an informal but strictly enforced position: closed-end funds investing over 15% of assets in private funds faced two constraints:

- Accredited Investor Requirement: Shares limited to investors with $1M+ net worth (excluding primary residence) or $200K/$300K annual income

- $25,000 Minimum Investment: A threshold that excluded most retail investors

This "regulation by comment letter"—never codified in formal rules—reflected concerns about retail investors' capacity to evaluate illiquidity, valuation opacity, and complex fee structures. The result was a two-tier market where wealthy individuals accessed private markets' outperformance while retail investors remained sidelined as assets grew from $4 trillion to $13.5 trillion over a decade.

The Regulatory Reversal: Opening the Gates

In May 2025, Chairman Atkins announced the SEC would abandon the 15% restriction, articulating his vision: "Financial innovation sometimes means getting out of the way of capital formation and allowing all investors to participate."

By August 2025, the policy shift became official, grounded in several key rationales:

Market Maturation: Private markets have evolved substantially since 2002, with enhanced disclosure requirements, improved valuation methodologies, and greater regulatory oversight transforming what was once the "Wild West" into more sophisticated asset classes.

Investor Demand: Survey data consistently shows strong retail appetite for alternative investments, particularly as traditional stock-bond correlations increase. Investors seeking true diversification increasingly view private markets as essential rather than speculative luxuries.

Structural Safeguards: Closed-end fund structures provide inherent protections. Unlike open-end funds, they don't face redemption pressures that could force fire sales. Their fixed capital base and exchange-traded structure create natural liquidity while insulating underlying investments from run risk.

Competitive Equity: Restricting access based on wealth rather than sophistication or risk tolerance creates unjustifiable inequality. If private markets offer superior risk-adjusted returns, limiting participation to the affluent perpetuates wealth concentration.

Private Credit's Explosive Growth: Opportunity and Risk

Private credit's meteoric rise provides essential context for this debate. According to the Bank for International Settlements, global private credit assets under management surged from $0.2 billion to $2.5 trillion over two decades, with U.S. loan volumes exceeding $1.2 trillion (87% of the global market).

Several forces drove this expansion:

Post-Crisis Banking Regulations: Dodd-Frank's stringent capital and liquidity requirements enhanced banking stability but made traditional lending less profitable. Private credit funds filled this void with flexible, customized solutions.

Yield-Seeking Behavior: In a low-rate environment, institutional investors dramatically increased private credit allocations, attracted by higher yields, diversification benefits, and floating-rate structures.

Borrower Preferences: Companies increasingly favor private credit's confidentiality, covenant flexibility, execution certainty, and relationship-based support over public market alternatives.

BDC Evolution: Business Development Companies—closed-end funds created by Congress in 1980—legitimized and scaled the model with permanent capital structures and tax advantages (90%+ income distribution requirement).

According to Deloitte's 2024 analysis, private credit now dominates leveraged buyout financing, including fintech acquisitions. This represents a structural transformation, not a temporary market aberration.

Innovation vs. Instability: Dueling Perspectives

Atkins' "no systemic risk" declaration contrasts sharply with warnings from financial stability experts and academics.

The Optimistic Case: Resilience Through Structure

SEC Commissioner Hester Peirce and private market advocates emphasize several resilience factors:

Asset-Liability Matching: Private credit funds typically use closed-end structures with five-year terms, matching loan portfolio duration and eliminating redemption risk that can destabilize open-end funds or banks.

Limited Systemic Leverage: While funds may use leverage, risk ultimately falls on fund investors' equity rather than government backstops or systemic financial infrastructure.

Market Heterogeneity: Unlike uniformly regulated banks, private credit markets exhibit healthy diversity in practices and risk appetites, preventing synchronized behavior during stress periods.

Counterparty Risk Management: Banks and regulated institutions interacting with private credit funds can implement their own risk controls and collateral requirements under their prudential regulators' supervision.

The Cautionary View: Hidden Interconnections

Critics, including University of Massachusetts Professor Lenore Palladino, highlight concerning dynamics:

Complex Interconnections: Private credit funds often finance private equity buyouts, creating circular relationships where neither debt nor equity faces traditional oversight. Default cascades can ripple through regulated institutions.

Valuation Opacity: Unlike publicly traded securities with continuous price discovery, private credit assets rely on models and assumptions. Stress periods may reveal overly optimistic valuations, triggering sudden write-downs and margin calls.

Liquidity Mismatches: While closed-end structures reduce fund-level redemption risk, insurance companies and other investors may face capital calls during exactly the periods when their own liquidity is stressed.

Regulatory Arbitrage: Credit provision migrates from heavily regulated banks to lightly supervised funds. Economic substance remains constant, but oversight diminishes, removing shock absorbers.

Form PF Delays Signal Priorities: In June 2025, the SEC postponed compliance deadlines for expanded Form PF reporting—the primary systemic risk monitoring tool. This second delay suggests the Commission views transparency requirements as burdensome rather than essential.

A June 2025 Moody's Analytics study using network analysis found statistically significant bidirectional risk transmission between BDCs and global systemically important banks. The researchers concluded that while private credit doesn't currently pose imminent systemic risk, its rapid growth and increasing integration with regulated institutions warrant enhanced monitoring—recommendations at odds with Atkins' assessment.

SEC-DOL Coordination: The Retirement Savings Frontier

Atkins' vision extends beyond SEC jurisdiction. In September 2025, he met with Labor Secretary Lori Chavez-DeRemer to coordinate expanding private market access for retirement savers. Speaking at Georgetown University, Atkins acknowledged challenges:

The Liquidity Challenge: "There's just not the liquidity necessarily" for private funds in retirement plans requiring periodic distributions, emergency withdrawals, and required minimum distributions. "You have to have a payday."

Valuation Difficulties: Atkins recognized "valuation issues" from the difficulty of daily pricing for illiquid assets—a fundamental tension with participant-directed accounts requiring daily valuations.

Guardrails Through Collaboration: Rather than prescriptive regulations, Atkins promised industry roundtables to develop appropriate "guardrails" collaboratively.

The potential infusion of retirement capital is staggering. With 401(k) plans alone holding nearly $9 trillion, even modest allocations could inject trillions into private markets—transformational growth for asset managers but introducing new risks for retirement savers.

Litigation and Compliance Risks

The removal of the 15% cap creates significant risks that practitioners must navigate:

Enhanced Disclosure Obligations: Investment advisers must ensure offering materials clearly articulate illiquidity risks, valuation methodologies, fee structures, including carried interest, correlation risks during market stress, and concentration exposures.

Suitability Determinations: While closed-end funds will be available to non-accredited investors, advisers must still evaluate whether private markets exposure aligns with client circumstances—investment horizon, liquidity needs, portfolio composition, risk capacity, and understanding of private markets dynamics.

Fiduciary Liability: ERISA fiduciaries selecting private market options for retirement plans face acute responsibilities. The DOL's "prudent expert" standard requires thorough investigation, fee structure understanding, performance monitoring, and ensuring alignment with participants' best interests.

SEC Examination Focus: While Atkins has suggested reduced enforcement intensity for compliance failures discovered during exams, advisers should expect continued scrutiny of disclosure adequacy, conflicts of interest, fee calculation, best execution, marketing rule compliance, and books and records.

Private Litigation Surge: Securities class actions and arbitrations historically surge when new products underperform. Private credit's untested performance during severe stress creates potential for significant losses and resulting litigation. Maintain robust due diligence documentation, preserve contemporaneous records, review insurance coverage, and prepare examination response procedures.

Historical Echoes: Lessons from Regulatory Optimism

Atkins' confidence that private markets pose no systemic risk invites comparison to previous episodes of regulatory optimism. His 2008 statement that Wall Street troubles wouldn't affect Main Street proved wrong within weeks. Several parallels warrant attention:

Complexity and Opacity: Pre-crisis, regulators underestimated structured products and OTC derivatives complexity. Today, private credit exhibits similar characteristics—bespoke agreements, complex structures, limited transparency, incomplete data.

Pro-Cyclical Behavior: Leading to 2008, competitive pressures loosened credit standards. Private credit shows comparable dynamics, with covenant-lite loans increasingly common and underwriting standards potentially deteriorating.

Regulatory Capture: The revolving door between industry and regulators, combined with sophisticated lobbying, can lead to policies prioritizing market participants over systemic stability. SIFMA actively lobbied for removing the 15% restriction—raising questions about whose interests the policy serves.

Practical Implications for Market Participants

The regulatory shift creates opportunities and obligations:

For Asset Managers and Fund Sponsors

Product Development: Design closed-end funds that balance private markets exposure with liquidity mechanisms—interval funds offering periodic redemptions, listed closed-end funds trading on exchanges, tender offer funds with scheduled liquidity events, multi-asset funds blending liquid and illiquid holdings.

Disclosure Enhancement: Develop clear, accessible communications that explain how private markets differ from public markets, why illiquidity can enhance returns but also create risks, how valuations are determined and their limitations, fee structures in plain language, and historical performance across various market cycles.

Distribution Strategy: Identify channels capable of supporting sophisticated products—registered investment advisers with alternatives expertise, broker-dealers with robust due diligence, direct-to-investor platforms with educational resources, retirement plan advisers with fiduciary expertise.

For FinTech Platforms and Technology Providers

Valuation Technology: Develop tools enhancing private asset valuation accuracy, transparency, and frequency using machine learning, comparable company analysis, and scenario testing.

Liquidity Analytics: Create platforms that model portfolio-level liquidity under various scenarios, helping advisers assess whether private market allocations align with client needs.

Risk Management Tools: Build systems to monitor private market exposures, flagging concentration risks, and providing early warning signals.

Regulatory Technology: Design compliance solutions helping advisers document suitability determinations, maintain required disclosures, and demonstrate best execution.

For Investment Advisers and Broker-Dealers

Enhanced Due Diligence: Implement rigorous processes for evaluating closed-end funds with private markets exposure—manager selection and monitoring, underlying strategy analysis, fee reasonableness assessment, historical performance evaluation, risk identification, and quantification.

Client Education: Develop materials and processes ensuring clients understand basic private markets mechanics, liquidity constraints and implications, appropriate allocation sizes, expected holding periods, and exit strategy limitations.

Suitability Documentation: Develop robust processes that document client-specific suitability analysis, alternative consideration, risk disclosure delivery and acknowledgment, and ongoing monitoring procedures.

Looking Forward: Three Scenarios

The coming years will test whether Atkins' optimism proves justified or whether private markets' explosive growth and retail participation create vulnerabilities materializing during the next downturn:

The Optimistic Scenario: Private markets continue to deliver strong, risk-adjusted returns. Closed-end structures prove resilient during stress. Enhanced disclosure and education enable informed decisions. Retail investors benefit from previously exclusive diversification. Democratization proves net positive.

The Cautionary Scenario: A severe economic downturn tests portfolios, revealing embedded leverage, optimistic valuations, and covenant-lite structures that provide insufficient protection. BDCs and closed-end funds experience significant NAV declines. Secondary market trading becomes dysfunctional. Retail investors, unfamiliar with the dynamics of private markets, often experience substantial losses. Lawsuits proliferate. Political pressure mounts for intervention.

The Balanced Path: Reality unfolds between extremes. Some funds succeed in providing disciplined access to private markets with appropriate risk management. Others overpromise and underdeliver. Some investors benefit from diversification and enhanced returns. Others suffer from misunderstanding or bad timing. Regulators gather experience, adjust policies iteratively, and refine guardrails based on emerging evidence.

Connecting History to the Present

The regulatory journey from the 2002 staff position to today's open access illuminates broader themes in securities regulation. The informal policy emerged from precautionary instincts rather than comprehensive analysis—a sense that retail investors lacked the sophistication to evaluate private fund risks.

Over the course of two decades, this restriction effectively excluded non-wealthy investors from participating in substantial private market growth. Critics argued that this was both paternalistic and unjustifiable, as it protected investors from opportunities rather than fraud.

The pendulum has now swung decisively toward access and market determination. Whether this proves prescient or reckless depends substantially on factors outside regulators' control—economic conditions, market participant behavior, and the inherent performance of private credit during stress.

Conclusion: Navigating the New Landscape

SEC Chairman Paul Atkins' declaration that private markets pose no systemic risk, along with his administration's removal of longstanding access restrictions, marks a pivotal regulatory moment. The policy shift reflects faith in market mechanisms, skepticism of government intervention, and commitment to expanding opportunities.

For legal practitioners, financial advisers, asset managers, and investors, this landscape demands vigilance, sophistication, and careful risk management. Opportunities are substantial—private markets historically deliver attractive returns and genuine diversification. Risks are equally significant—illiquidity, opacity, complexity, and potential for severe losses.

Several principles should guide decision-making:

Transparency Over Opacity: Enhanced disclosure, frequent communication, and honest limitation assessment serve investors' interests and protect participants from litigation and reputational harm.

Suitability Over Sales: Recommend private market exposure only when genuinely appropriate for a specific client's circumstances, not pursuing asset growth regardless of the fit.

Humility Over Hubris: Acknowledge that private markets' performance during severe stress remains uncertain, that models and valuations contain assumptions that may prove wrong, and that overconfidence invites disaster.

Long-Term Perspective: Recognize that private market investments require patient capital, extended time horizons, and tolerance for interim volatility and illiquidity.

The removal of the 15% restriction marks not an ending but a beginning—the start of a significant experiment in financial democratization whose outcomes will unfold over years and economic cycles. Success depends substantially on market participants' choices: products designed, disclosures provided, due diligence conducted, and clients served.

At FinTech Law, we help clients navigate this evolving landscape with expertise, integrity, and strategic foresight. Whether you're an asset manager developing products, an adviser evaluating offerings, or an investor seeking to understand opportunities and risks, we provide legal counsel and strategic guidance necessary for success.

The private markets revolution is underway. Whether Chairman Atkins' optimism proves justified or his dismissal of systemic risk concerns becomes another chapter in regulatory overconfidence will depend on how well market participants execute in this new era.

About FinTech Law

FinTech Law provides comprehensive legal counsel to investment advisers, fund managers, broker-dealers, and financial technology companies navigating the complex intersection of securities regulation, investment management, and technological innovation. Our team combines deep regulatory expertise with practical business understanding to help clients capitalize on opportunities while managing compliance risks.

Contact us to discuss how these regulatory changes affect your business and develop strategies for success in the evolving private markets landscape.

Related Reading:

- SEC Private Funds: Retail Access 2025 - Complete guide to navigating the new retail access framework

- Closed-End Funds & Private Investment Restrictions: SEC History - Historical evolution of closed-end fund regulations

- Private Funds 2024: Key Trends & Developments

This content was prepared with AI assistance to ensure comprehensive coverage of complex regulatory developments.